Gurgaon-based Renewable energy firm ACME Solar Holdings Ltd have received regulatory nod to float its initial public offerings. The Securities and Exchange Board of India (SEBI) issued final observations to ACME Solar on 15 December’17.

ACME Solar Holdings plans to issue shares worth Rs 2,200 crore ($335 million) to pay debt and financing a power project, according to the draft red herring prospectus.

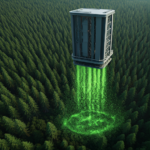

ACME Solar is one of the largest solar power producers in India, having a portfolio of operational and under-construction projects with total capacity of 2,351 megawatt peak, or 1,814 megawatt.

ACME has proposed to use the net proceeds to repay and make advance payment of certain debts, including a loan of Rs 435.69 crore from Piramal Finance and Innovador Traders Pvt. Ltd. The company also aims to repay a loan of Rs 541 crore availed from the promoter entity ACME Cleantech. The company has set aside Rs 869 crore to fund engineering, procurement and construction works for the Bhadla power project in Rajasthan and the remaining amount for meeting expenses towards general corporate purposes.

ICICI Securities, Citigroup Global Markets India, Deutsche Equities India are the merchant bankers managing the IPO.