Global supply of solar equipment and products has been severely affected by Coronavirus pandemic. The Indian solar industry was already facing several challenges and is coming off a weak year.

Solar installations in 2019 only amounted to 7.3 GW, a 15% decline year-over-year.

Indian solar project developers are concerned about the delays their projects might face because of the production slowdown in China and the lockdown orders in India, which are in effect until April 14, 2020.

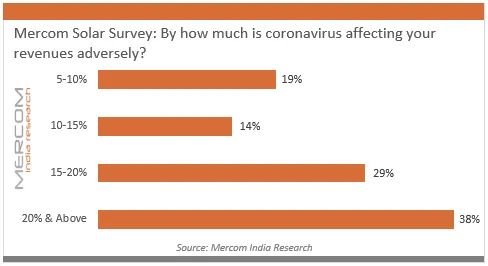

In a recent online survey conducted by Mercom India Research,

- almost 70% of the respondents said their business would be affected by over 15% due to Coronavirus.

- 83% of the survey participants expect solar component supply shortages because of Coronavirus.

China was the largest exporter of solar modules and cells to India in the calendar year (CY) 2019, with a market share of nearly 78%.

The outbreak of coronavirus has led to delays in the procurement of modules, panels, inverters, and other small components, further leading to a delay in commissioning deadlines.

Lockdowns in China have forced manufacturers to run their facilities at lower utilization rates or to stop operations completely. Even manufactured modules are facing delays because of export and import restrictions at ports.

Although it is an evolving situation, and the long-term impact of the pandemic is still to be seen, the Indian government has declared it as a force majeure situation for project developers who would miss deadlines due to the effect of the coronavirus outbreak.

The government’s move allowing the force majeure clause to be invoked for cases where genuine delays and disruptions is a good start for the industry.

The relief it gives for the developers is similar to the “change in law” clause that was allowed previously for delays and inconveniences due to the imposition of safeguard duty.

Reference- Economic Times, Mercom India, Business Standard, MNRE website & PR