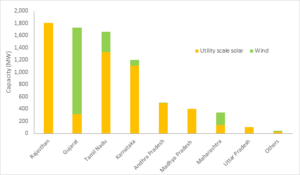

According to MNRE, in FY2020 (April 2019 till March 2020), about 5.7 GW of new utility-scale solar capacity was added in India. This is about 24% lesser than the government target of 7.5 GW set for this year. In FY2020, Rajasthan added a maximum capacity of 1.8 GW, followed by Tamil Nadu with 1.3 GW addition and Karnataka with 1.1 GW addition.

Together these three states contributed about 74% of all utility-scale solar installations in India in FY2020. Neyveli Lignite Corporation (NLC), SB Energy, and ReNew were the leading project developers to add maximum solar capacity in FY2020.

Of these three leading developers, ReNew has managed to add over 15% of all utility-scale solar capacity in India in FY2020. Also, among the leading developers, SB Energy has accumulated capacity of 7% of all solar capacity additions in India in FY2020.

On the wind side too, MNRE reports, in FY2020, about 2.1 GW of new wind capacity is added, which is about 30% lesser than the Government target of 3 GW set for FY2020. Compared to previous year installations, FY2020 wind installations are about 31% higher.

Gujarat led the installations with the commissioning of 1.4 GW of new wind projects, followed by Tamil Nadu (335 MW) and Maharashtra (206 MW). Inox, SembCorp, Mytrah, ReNew, and Greenko were the leading players who added maximum wind capacity in FY2020.

India is one of the world’s largest wind power exporters. However, MNRE is aiming to make it one of the top two wind power generators in the world by 2030. Even with the current low cost of wind power in India, experts agree that more effective policy measures are required like faster clearances and execution of ground leases and most importantly, stronger incentives that cover operating and maintenance costs.

One of the reasons for the delay in the commissioning of projects can be the impact of lockdown in China first (starting Jan 2020) and then in India due to the COVID-19 issue.

Reference- MNRE website, JMK Research