Annual global investments in green hydrogen – hydrogen production powered by renewable sources – are now expected to exceed $1billion USD by 2023.

The elevated investment outlook is attributed to falling costs and policy support from governments looking to shift towards low carbon economies.

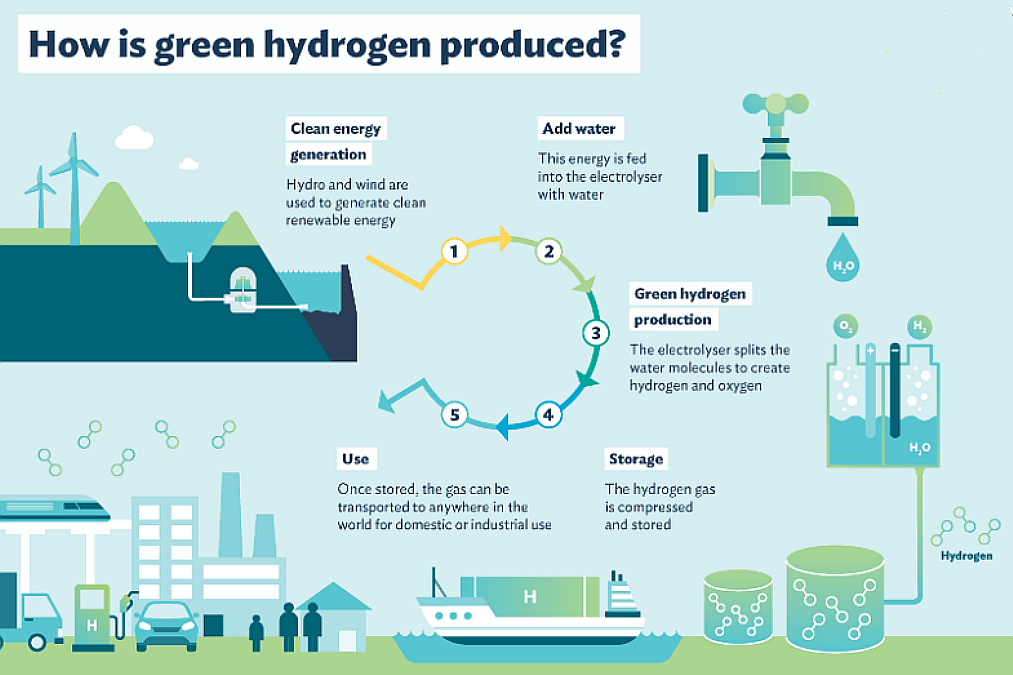

Operating capacity for splitting water into hydrogen and oxygen through electrolysis technology (also known as “Power-to-X”) currently stands at 82 MW with a pipeline of over 23 GW, according to the IHS Markit Power-to-X tracker.

The growth in the electrolysis pipeline has been driven by falling costs and policy support. Green hydrogen production costs are down 40% since 2015 and are expected to fall by a further 40% through 2025.

Through 2025, the main driver of green hydrogen cost reductions is expected to be the development of larger electrolysis projects.

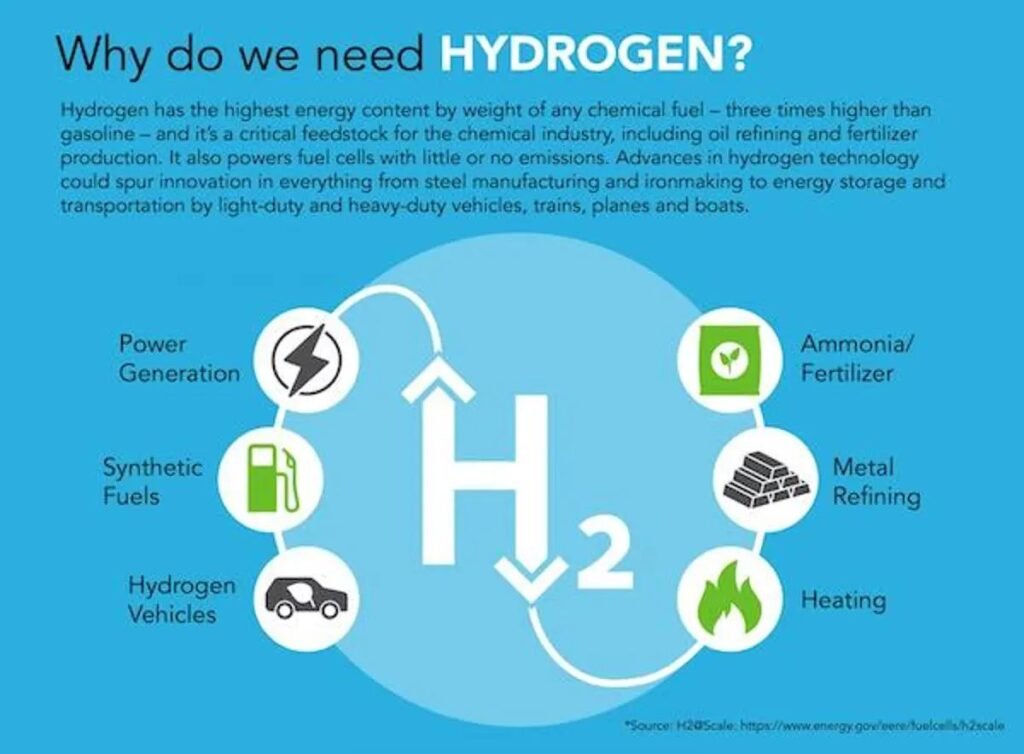

Low-carbon hydrogen is a major component of many governments post-COVID recovery plans and their long-term climate strategies. 6 European countries, the European Commission, Russia and Chile have all released hydrogen strategies since May 2020.

The strategies lay out production targets for low-carbon hydrogen and electrolysis and start to define the support that will be available to project developers.

By 2030, IHS Markit expects that green hydrogen costs could drop below $2/kg. This cost is the Holy Grail for electrolysis as this is where green hydrogen starts becoming competitive with traditional hydrogen.

Hydrogen production has the potential to become a whole new sector of electricity demand. Large scale development of renewable generation will be required to support it.

Reference- IHS Markit Power-to-X tracker, Bloomberg, Forbes, The Guardian