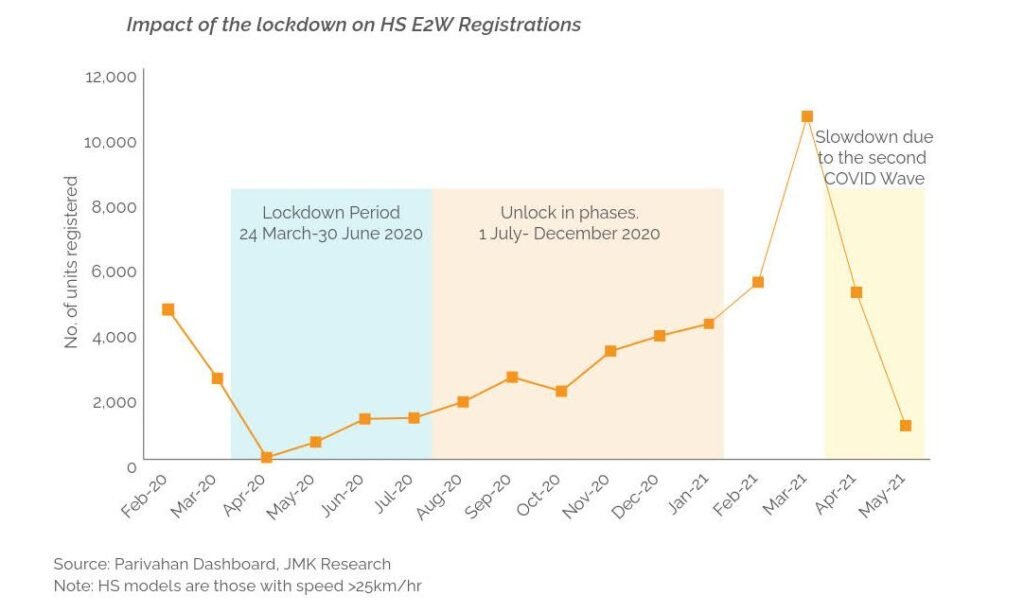

FY2021 saw the electric 2-wheeler (E2W) sales decline marginally by 5.4% from 152,000 units in FY2020 to 143,837 units in FY2021 due to the disruption caused by the COVID-19 pandemic.

However, sales of High speed (HS) electric 2-wheeler (models with speed >25km/hr) witnessed an YoY increase of 47%.

Established players such as Hero Electric and Okinawa commanded over 53% of the market share for HS E2Ws in FY2021. Budding players such as Ather, Revolt and Pure EV too increased their respective shares in the market.

FY2021 witnessed a slowdown in terms of the investments made in the E2W space as compared to the previous years, since the COVID pandemic disrupted and delayed plans of various organizations.

In a divergence from previous years’ trends, however, the investments in E2W OEM space have been higher than that in shared mobility sector this year.

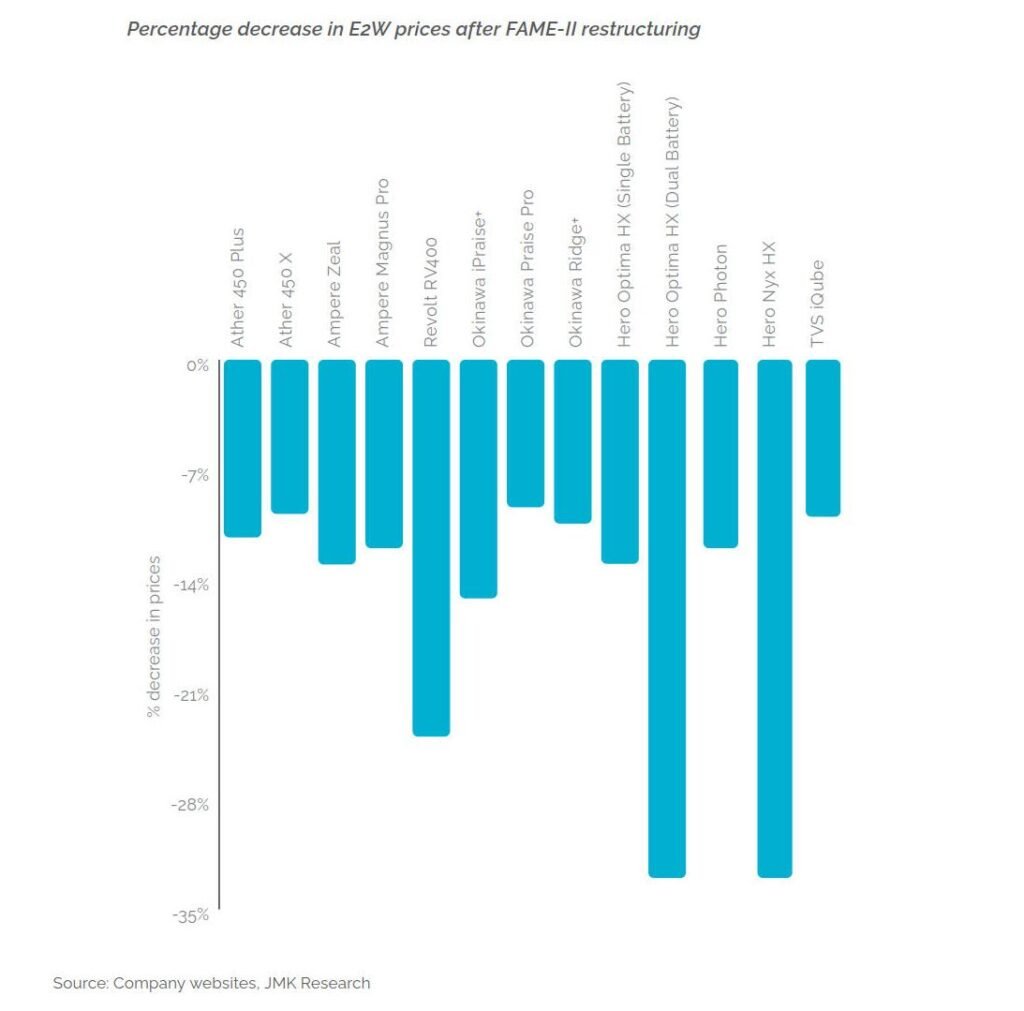

High upfront costs were one of the main barriers to EV adoption in India. However, following the recent restructuring of the FAME-II scheme, incentives for electric 2-wheelers have been increased from INR 10,000/kWh to INR 15,000/kWh and cap on incentives has gone up from 20% to 40%.

This has driven down the prices of E2Ws, bringing it closer to the prices of ICE-2 wheelers.

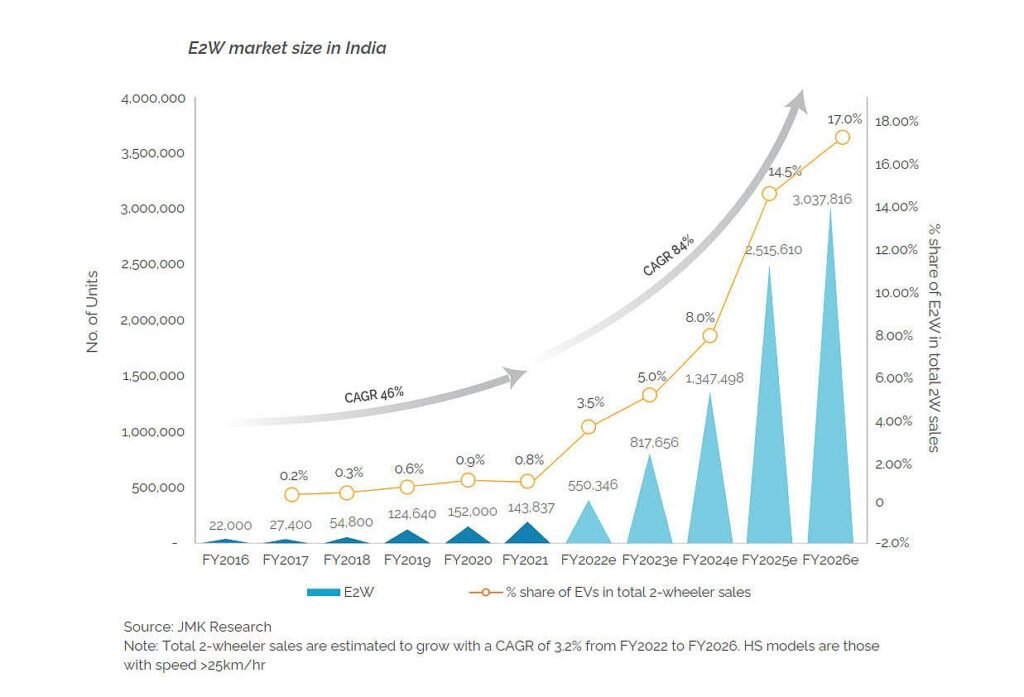

JMK Research estimates that E2W sales would reach 30 lakh units in the next 5 years, witnessing a CAGR of 84% from FY2021 to FY2026. The growth engine of the E2W market will be fueled by various drivers, of which strong governmental push and affordability would play key roles.

This article is based on JMK Research Newsletter; edited by Clean-Future Team