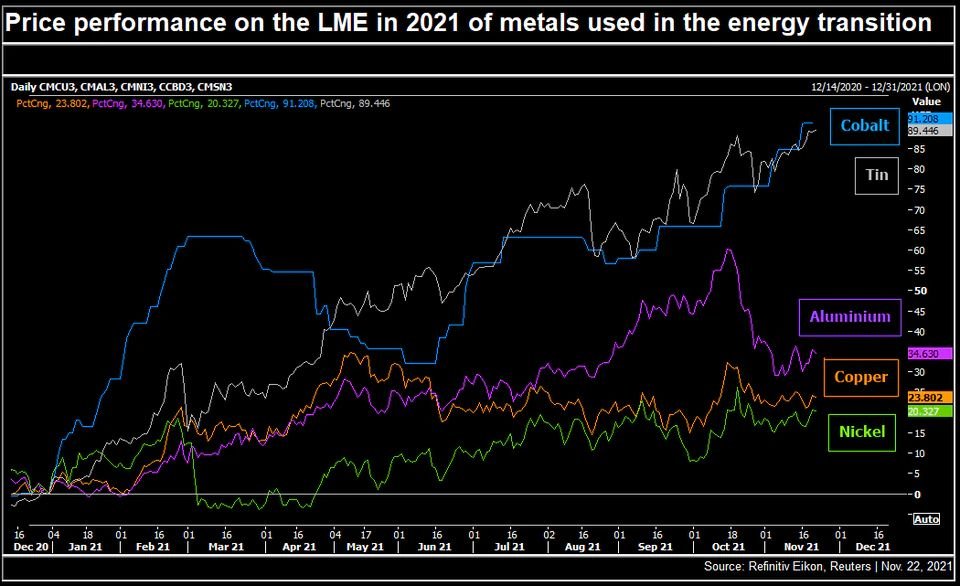

Greenflation, or the expenses associated with becoming green, may be a worry for many companies in the short term, since the prices of metals such as tin, aluminum, copper, nickel, and cobalt, which are required for energy transition technologies, have increased by between 20% and 91% this year.

However, according to the Council on Energy, Environment and Water (CEEW), the declining cost of financing “green projects” may offset the increase in commodity costs during the same time. Meaning, though the prices for raw materials used in renewable energy are increasing, this will raise the cost of establishing new green energy projects, but will be mitigated by increased access to capital and economies of scale.

Costs will decrease when economies of scale kick in, including permit fees, installation labor, and customer acquisition costs.

According to the International Renewable Energy Agency (IRENA), despite inflation and supply chain interruptions, declining finance costs helped create a new record for renewable energy output last year, totaling 260 gigawatt-hours.

The worldwide renewable energy industry is expected to more than double in size to about $2 trillion by 2030, from over $881 billion in 2020. Thus, growing prices will not pose a long-term danger to clean energy’s economic sustainability.

Reference- IRENA website, CEEW website, Reuters, Mercom India, BloombergNEF