Globally, there is a lot of cash available for late-stage fundraising, and funds are coming together for early-stage investing in the Northern US and Europe. However, there is a white space potential in India for tech-led early stage climate and sustainability initiatives.

To capitalize on this potential in India, Avaana Capital, an early-stage investment firm, has announced the formation of a $150 million climate change and sustainability fund, in which all investments would be made through the lens of climate and sustainability change.

Seventy percent of the company’s current portfolio is tied to sustainability, and they have fared exceptionally well. They now intend to include energy transition and resource management in the air and water.

Avaana Capital, on the other hand, is not the first fund in India to invest with a climate change and sustainability mindset. Despite being a relatively new idea, Everstone Group and GEF Capital Partners have achieved significant progress.

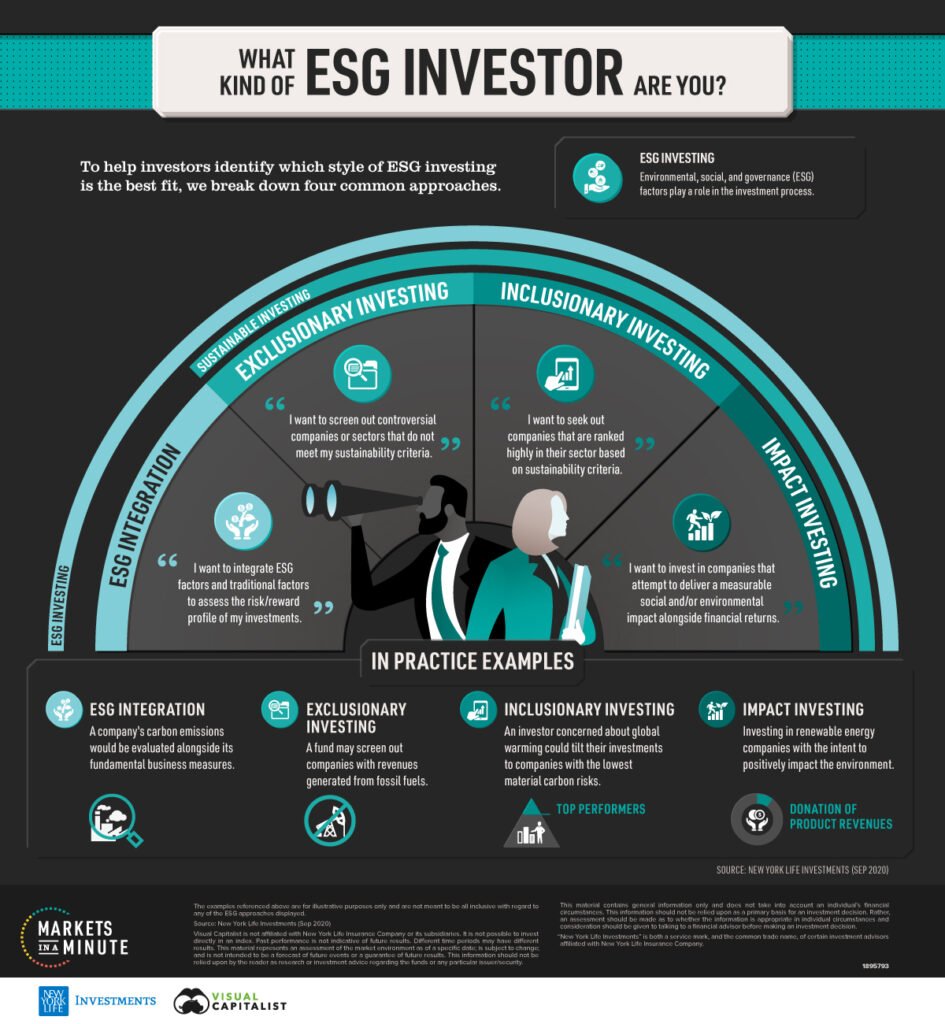

Lumis Partners, for example, is preparing to develop a climate change fund. The term “sustainability” refers to the ESG (Environmental, Social, and Governance) framework in general. Any investment made via a climate or environmental lens now has a higher valuation multiple from the perspective of an investor.

Capital devoted to ESG was roughly $5-6 trillion five years ago; by 2022, it had quadrupled to $30 trillion. Fear of catastrophic global warming is causing nations, corporations, individuals, and capitalists to reevaluate their actions.

Reference- Businesswire, Avaana Capital, Mercom India, Money Control, Economic Times, Live Mint