As electric vehicle sales climb, the sector faces a slew of bottlenecks:-

- Ramping up manufacturing of batteries and the raw materials that go into them takes time.

- Asian businesses now dominate global battery production.

- Much of the required raw material is mined in unstable nations or in countries with poor environmental and human rights records.

- Mining and processing of raw materials provide environmental issues that make increasing local production difficult.

Some industry experts (among others) are warning of impending major mineral shortages. Commodity experts have also issued concerns regarding the availability of graphite, nickel, cobalt, lithium and a slew of other specialty minerals required for batteries.

While the constraints are real and require aggressive action from automakers, suppliers, and governments, those making the most dismal predictions are undoubtedly underestimating the value of human innovation (and the human desire for profit).

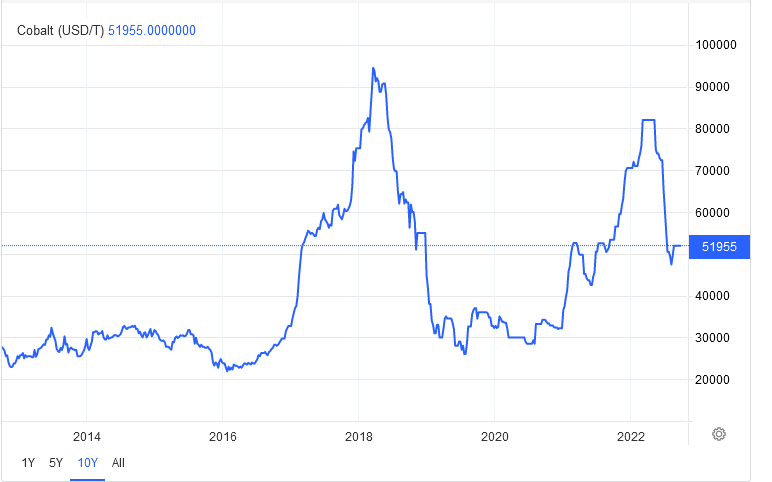

For example, a feared shortfall did not materialize thanks to efforts on both the supply and demand sides. Prophets predicted a devastating cobalt shortage a few years ago, and now they foresee a lithium shortage. However, in the event, prices for cobalt have fallen about 40% from their highs earlier this year.

Obviously, higher pricing encouraged mining companies to boost supply. However, the cobalt market has been impacted by demand-side actions as battery producers and automobiles attempt to utilize less of the hazardous material.

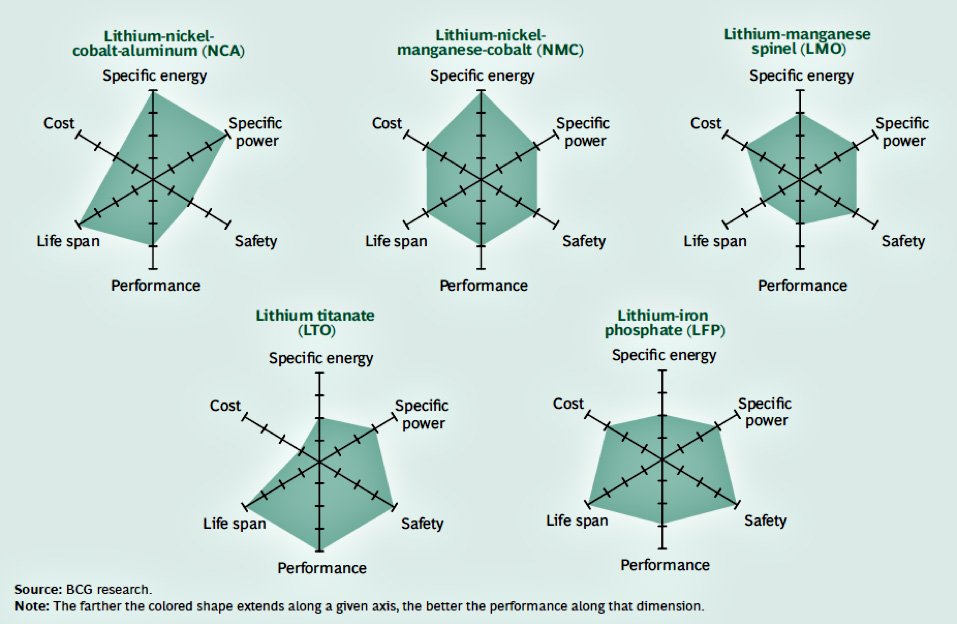

According to Bloomberg, cobalt-based battery chemistries were utilized in 86% of all EVs shipped in 2018. That share has declined to 83% by 2020, and it is predicted to shrink to 60% this year.

Automobile manufacturers are increasingly opting for lithium-iron-phosphate (LFP) chemistries that do not contain cobalt. BYD and CATL have been employing the chemical for some time, and Tesla began providing consumers the option of choosing between two different battery chemistries in late 2021.

The scenario here is actually an old one: high prices for a certain commodity encourage greater manufacturing, which increases supply, and other advances, which diminish demand. This is capitalism’s invisible hand at work, and it’s realistic to expect similar events to play out in the future when it comes to other essential minerals like lithium.

Reference- Bloomberg, Trading Economies website, Reuters, Business Insider, EVANNEX