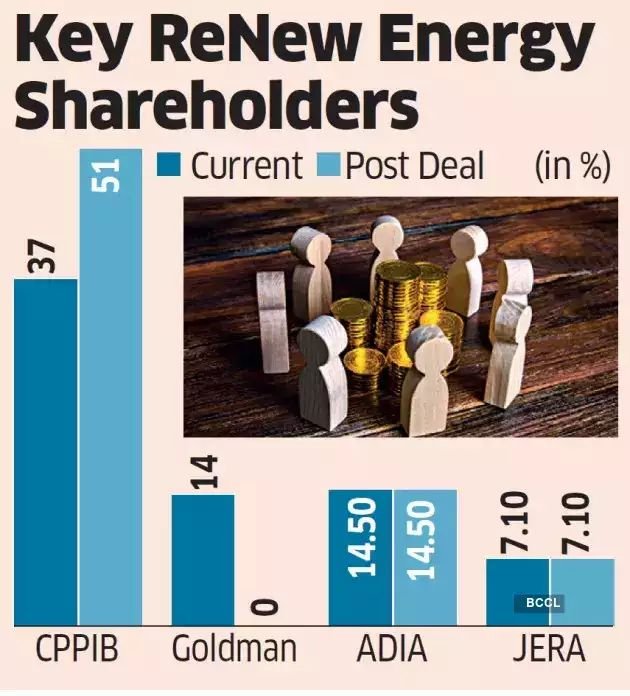

Goldman Sachs is planning to sell its remaining 14% ownership in ReNew Energy Global to Canada Pension Plan Investment Board (CPPIB) for around $268 million.

After the transaction, the pension fund, one of the largest in the world, will become ReNew’s dominant stakeholder, with a holding of more than 51%. The transaction will allow Goldman to depart ReNew, one of India’s leading renewable energy firms.

The Wall Street firm, which was an early investor in Sumant Sinha’s ReNew, has gradually reduced its investment in the company. Canada Pension Plan, which manages over $536 billion in assets, has progressively increased its stake in the firm.

The Canadian Pension Plan’s decision to grow its interest in ReNew is part of a larger initiative to enhance investments in the renewables sector. ReNew’s capacity exceeds 13.4 GW. Pension funds and global investment corporations with an emphasis on environmental, social, and governance (ESG) investments have been on the lookout for new possibilities in clean energy programs.

Abu Dhabi Investment Authority has a 14.5% stake in ReNew, while Japan’s JERA has a 7.1% stake. Public stockholders own around 22% of the company.

This is a Syndicate News Feed; edited by Clean-Future Team