Over the past five years, the Indian wind energy business has encountered considerable challenges. Solar’s worldwide levelized cost of electricity (LCOE) fell at a rate of 11% per year, quicker than wind’s (about 5%), causing customers to gravitate towards solar options due to the rapid LCOE decline and plenty of sunlight in India.

Furthermore, the switch in wind energy pricing mechanisms in 2017 from feed-in-tariff (FIT) to reverse auctions resulted in aggressive bidding from IPPs, hurting margins across the value chain.

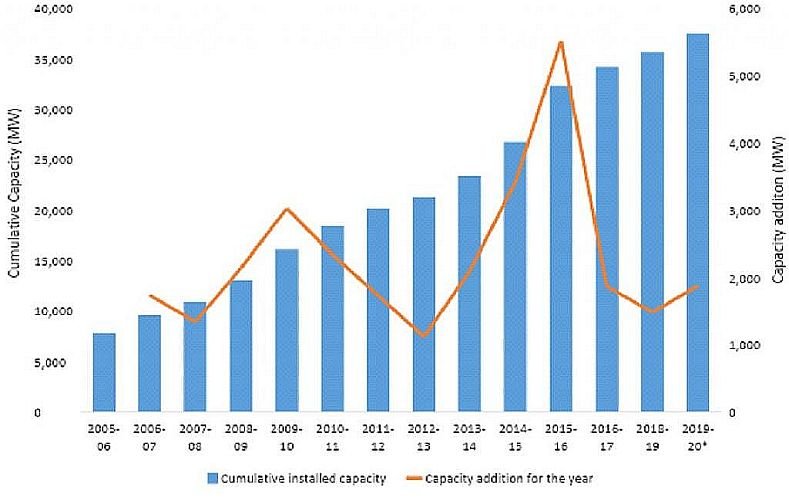

While the rate of wind capacity installation has been slower than expected over the last five years, there is growing optimism about the wind energy market’s potential, driven by a greater emphasis on hybrid (solar and wind) solutions, select wind-related policy changes (e.g., the introduction of single-stage, closed-envelope bidding), and increased focus on hybrid (solar and wind) solutions.

Independent Power Producers (IPPs) can use wind to supplement solar as hybrid round-the-clock (RTC) energy regulations grow. This allows them to increase their PLF from 20%-25% for solar-only plants to 40%-45% for hybrid plants (up to 60% with storage).

The growing emphasis on net zero objectives for businesses, particularly in difficult-to-abate industries such as metals, cement, and chemicals, makes C&I an appealing customer area for IPPs. Furthermore, certain governmental measures (for example, the Green Open Access Policy) have enhanced the affordability of green power for C&I consumers. India is expected to add 50–60 GW of wind capacity by 2030, bringing total installed capacity to 90–100 GW.

Reference- Economic Times, Mercom India, PV Magazine, Business Standard