Sand, a seemingly common resource, hides a secret: only a specific type is crucial for high-tech components in smartphones and solar panels. This “special sand” boasts over 99.9% silica, far exceeding the 80% used in construction.

Unfortunately, it’s incredibly scarce. Less than 1% of the 50 billion tons mined annually qualifies for even regular glass, with a smaller fraction reaching the purity needed for solar panels.

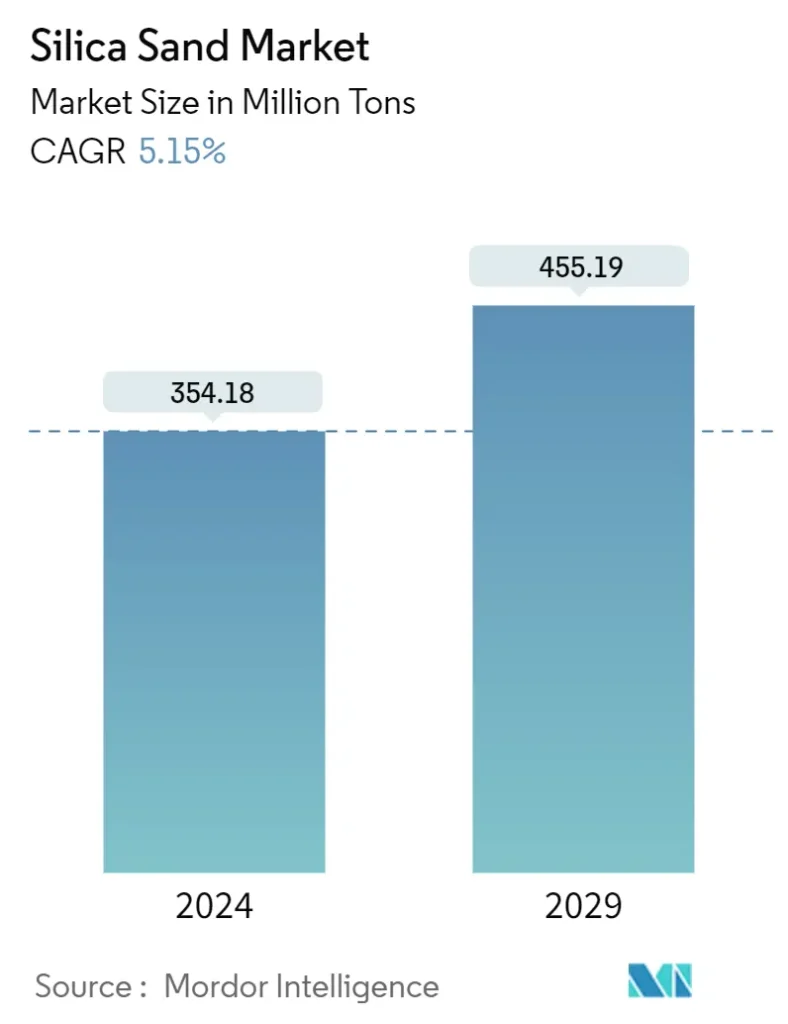

China’s push for green manufacturing – batteries, electric cars, and solar panels – is fueling demand for this specialized sand. As production ramps up, so will the pressure on this limited resource. Prices are already near record highs, hovering around $55 per ton.

The market is complex. High-quality sand prices have doubled compared to lower grades in the past five years, driven by green tech and our love for smartphones. Strict export controls in Asia and mining regulations in the US further limit supply. This creates an opportunity for illegal mining, estimated to be a multi-billion dollar black market.

Australia and Brazil, with their vast reserves of industrial sand located away from populated areas, stand to benefit from this legal boom. Soaring prices now make shipping this cost-effective. These countries, independent of China’s influence, could strengthen Western supply chains.

History suggests prices of green tech materials like cobalt and lithium have spiked before falling as new sources or substitutes are found. High-quality sand might follow this trend, but the wait could be uncomfortable for manufacturers in the meantime.

Reference- The Economist, Hindustan Times, Moneycontrol, BloombergNEF