India’s electric vehicle (EV) leader Ola Electric faces an investor hurdle. The company, aiming for a $7 billion valuation in its upcoming IPO, might be asking for too much.

SoftBank, Tiger Global, and Temasek have backed Ola, hoping it would lead India’s EV revolution. Scooters dominate India’s two-wheeler market, with 17 million sold annually compared to just 3.4 million cars. Yet, electric scooters remain a tiny niche.

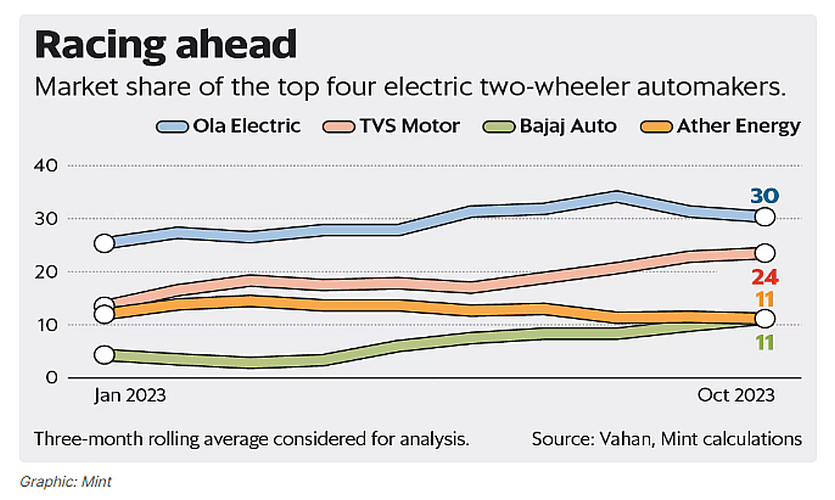

Founded by Bhavish Aggarwal, Ola began deliveries in 2021 and quickly captured over a third of the electric scooter market. But rivals are catching up fast. Bajaj Auto, valued at $32 billion, doubled its market share to 11% in the last year. TVS Motor aims for EVs to be 25% of its sales by 2027.

Unlike profitable giants like Bajaj and TVS, Ola remains unprofitable. It’s projected to generate $614 million in revenue this year. A $7 billion valuation translates to a price-to-sales ratio of 11, much higher than its established competitors.

Ola’s pure electric focus makes it vulnerable too. It recently cut scooter prices after the government lowered EV subsidies. Bajaj and TVS, however, have a strong foothold in the massive $100 billion export market for Indian-made two-wheelers.

Aggarwal’s vision deserves a premium, but with many Indian startups trading below IPO prices, a more realistic valuation might attract investors and differentiate Ola from the crowd.

Reference- Economic Times, InsideEVs, CNBC, NDTV