Finnish energy giant, Fortum, is exiting the Indian market. The company has appointed EY and Opus Corporate Finance to offload its majority stakes in Fortum India Pvt. Ltd (FIPL) and GLIDA, respectively. These deals are valued at approximately $300 million.

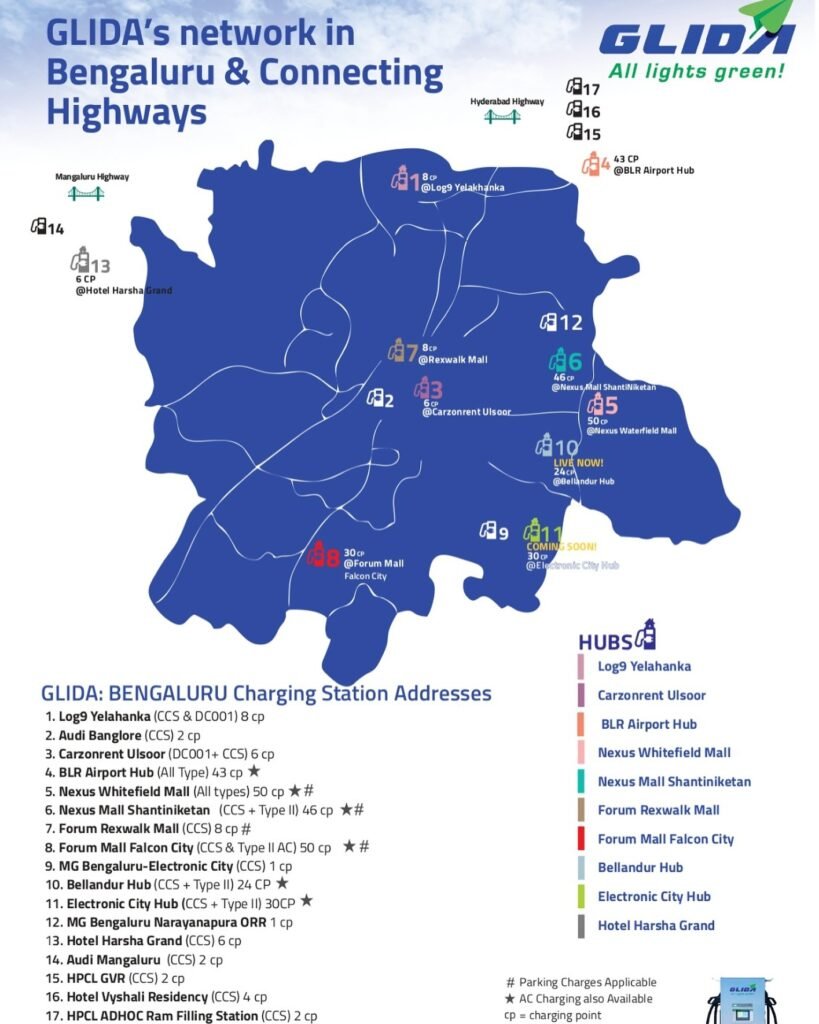

FIPL, Fortum’s renewable energy arm, boasts a 200 MW hybrid project and a 600 MW pipeline. GLIDA, its EV charging network, operates around 850 charging points.

This strategic retreat stems from geopolitical challenges. Fortum’s subsidiary, Uniper, suffered huge losses due to the Ukraine war. Russia also seized Fortum’s assets worth €5 billion. These events forced the company to prioritize its Nordic market.

Fortum’s departure marks a significant setback for India’s renewable energy and EV sectors. The company’s expertise and investments have been crucial. The government must now attract new players to fill the void.

India’s renewable energy ambitions are ambitious. However, challenges persist. Policy stability, grid integration, and financing remain crucial. The government needs to address these issues to attract investments and achieve its targets.

Fortum’s exit serves as a stark reminder of the complexities in the energy sector. Geopolitical risks and financial pressures can significantly impact foreign investments. India must strengthen its domestic capabilities to reduce reliance on foreign players.

Reference- Mercom India, Economic Times, Business Standard, Fortum website &PR