BYD continues to dominate the global auto market, setting a new record with 485,000 registrations in November. Despite relying heavily on its domestic Chinese market, where over 90% of its sales occur, BYD’s minimal exports (31,000 units) signal untapped potential for global expansion. Markets like Brazil, Mexico, and Australia could drive future growth.

Tesla’s performance has been inconsistent, with November sales dipping 1% year-over-year. However, 2025 looks promising, thanks to the Model Y refresh and a potential budget-friendly model debuting later in the year.

Geely climbed to 3rd place with 89,000 registrations, marking a new high. Its upcoming models, like the Galaxy Starship 7, hint at further growth in 2025. Wuling followed in 4th place with 81,000 units, while Li Auto secured 5th with a 20% year-over-year increase.

Other Chinese brands are on the rise. Leapmotor achieved its 4th consecutive record with 40,000 units, while Xpeng delivered 31,000, fueled by its Mona M03 and P7+ models. Deepal and Zeekr also hit new milestones, with 27,477 and 27,000 registrations, respectively. Notably, Xiaomi entered the top 20 with its SU7 sedan, selling 23,156 units.

In the year-to-date (YTD) rankings, BYD outperformed Tesla, with double the registrations. Tesla remains ahead of Wuling, which has secured 3rd place. Geely, now 5th, is rapidly closing in on BMW for 4th, signaling its growing influence in the electric vehicle (EV) market.

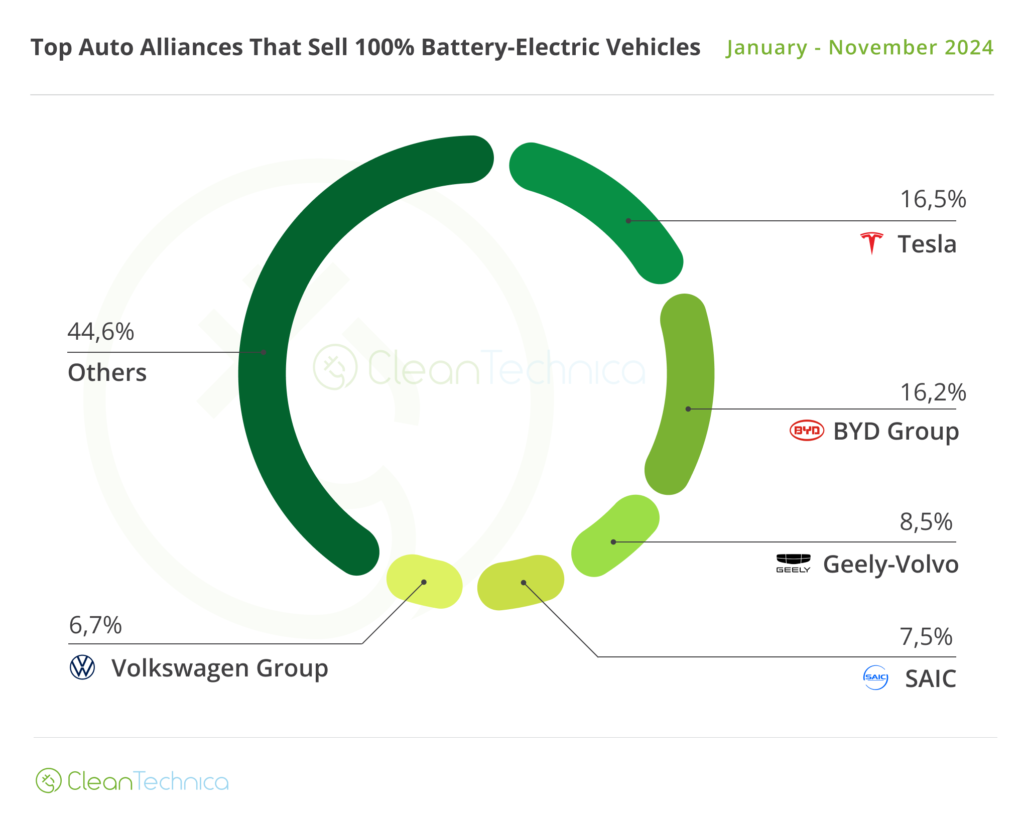

Top Auto Groups Overview

BYD maintained its leading position among auto groups, increasing its market share to 24.4%, compared to 22.1% a year ago. Tesla, in 2nd, saw its share decline to 10.4% from 13.3% in 2023. Geely–Volvo rose to 3rd with an 8.2% share, solidifying its upward trajectory.

Volkswagen Group retained 4th place but saw its lead over SAIC shrink as Wuling’s strong performance boosted SAIC to a 5.5% share. Changan, in 6th, benefited from Deepal’s success, while legacy automakers like BMW, Hyundai–Kia, and Stellantis struggled, losing market share.

Tesla leads in battery electric vehicle (BEV) sales with a 16.5% share, but BYD is closing in at 16.2%. Geely–Volvo, with an 8.5% share, has shown remarkable growth over the past year, positioning itself as a future contender for the top spot.

As legacy automakers lose momentum, Chinese brands continue to gain ground, reshaping the global automotive landscape.

Reference- Clean Technica article, The Verge, BBC, Forbes, Inside EVs