In June 2020, the Central Electricity Regulatory Commission (CERC) published an order revising the prices of Renewable Energy Certificates (RECs).

CERC removed floor price and proposes new Forbearance price of INR 1000 for solar and non-solar RECs.

The new prices will be applicable to all certificates issued after April 01, 2017. Considering the historical price trend of RECs, this is the fourth revision in floor and forbearance prices by CERC.

The prime reason for this price revision is that there has been a decline in the tariff discovered through competitive bidding for both solar and wind projects.

During 2019-20, the average bid tariff discovered in the auction for solar projects is INR 2.74/kWh and that for wind projects is INR 2.85/kWh. Thus, it is evident that the market has matured, and to encourage the sale of certificates and promote trade, the floor price is not required.

With the removal of a floor price, obligated entities, mainly state DISCOMs, which are non-compliant will now have an option to purchase certificates at lower prices and fulfill their RPO targets.

This, in turn, is likely to increase the demand for certificates leading to higher trading volume.

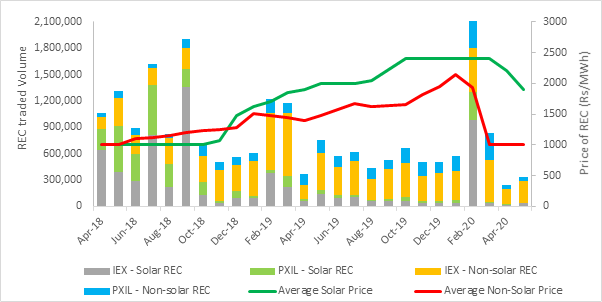

In the YoY comparison of trading of RECs on both platforms, there is about 28-32% decrease in volumes of certificates traded. This was mainly because, in FY2019 (Apr 2018 to Mar 2019), trading of Solar certificates resumed after a gap of almost one year. Hence, demand was robust in the initial few months.

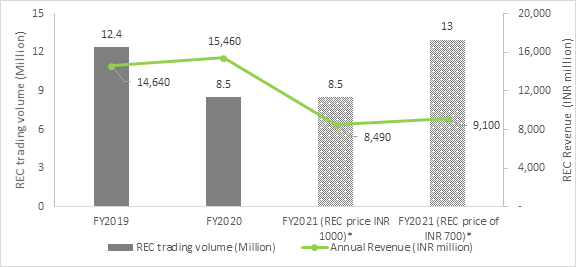

With new revision going to be effective from June 1, 2020, as per JMK Research estimations, for FY2021 (Apr 2020 to Mar 2021), assuming the volume traded remains same as that of previous year i.e. total 8.5 million certificates at a price of INR 1000, then about INR 8,490 million certificate trade is likely to be generated.

In the second scenario, if we assume a 50% rise in trade of certificates to 13 million at an average price of INR 700/REC, then about ~ INR 9,100 million certificates trade is likely to be generated.

In both the scenarios, annual trade is likely to fall by about INR 6– 7 billion.

This story is based on inputs from ‘JMK Research & Analytics’