Macquarie Capital and Siemens have formed a joint venture to finance and build distributed energy projects. The partnership will be called Calibrant Energy.

It will initially focus its ‘energy-as-a-service’ model (EaaS) in the United States, where corporate and industrial customers have become heavyweight renewables buyers as they seek to reach decarbonization goals.

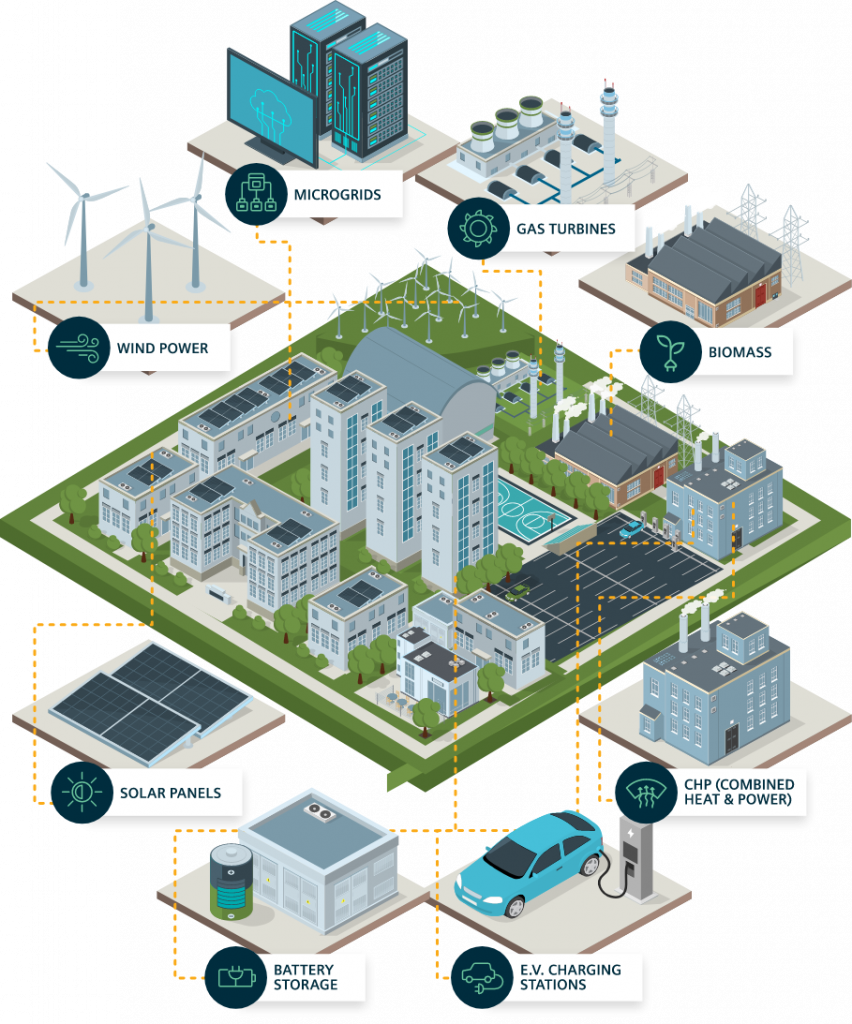

Calibrant will offer a range of energy solutions — including solar, storage and microgrids — for C&I customers, as well as the so-called “MUSH” market of municipal entities, schools and hospitals.

The JV will fund projects with no-money-down terms for customers, and earn money through revenues from long-term power purchase agreements.

Siemens will build the projects and handle operations and maintenance, although the venture may work with development partners as well, depending on the project.

Both companies are providing equity investment for the partnership, though they declined to name the amount. Siemens Financial Services has also offered up a revolving credit facility.

Though Siemens has some technology solutions, the JV will remain technology-agnostic. The new partnership’s offerings range from solar-plus-storage to microgrids and combined heat and power systems.

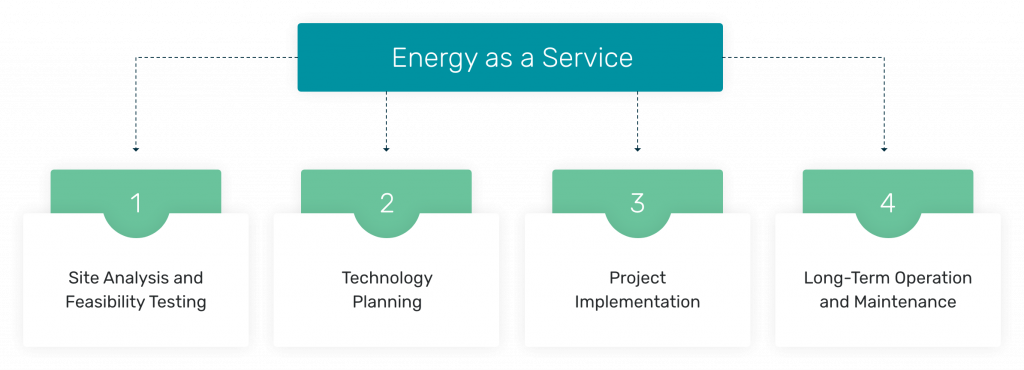

Calibrant Energy offers a unique combination of technical, operating, and risk management expertise that enables customers to access the benefits of on-site energy systems with a new level of simplicity. Using an EaaS model, Calibrant will build onsite energy solutions that seek to deliver immediate cost savings, cost certainty, resilience and low-cost energy grid augmentation.

Calibrant’s technologies will include solar, integrated solar-battery solutions, hybrid systems, standalone batteries, microgrids, combined heat and power, and centralized heating and cooling infrastructure upgrades.

This is a Business Wire Feed; edited by Clean-Future Team