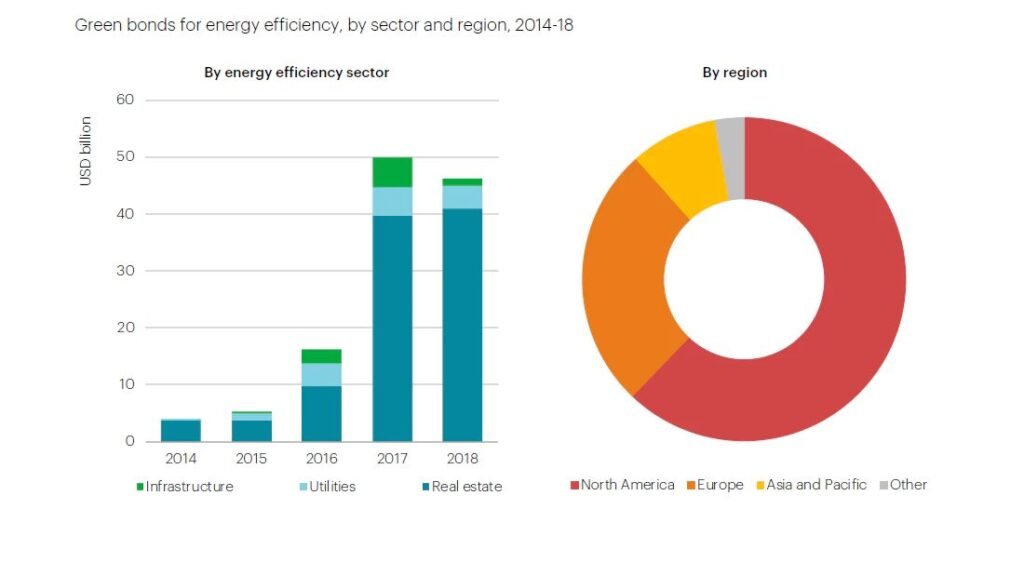

In a first-of-its-kind private credit fund financing, the Asian Infrastructure Investment Bank (AIIB) has approved a USD100-million investment into the ADM Capital Elkhorn Emerging Asia Renewable Energy Fund targeting small and medium-sized enterprises (SMEs) and projects operating in the renewable energy and energy efficiency sectors across emerging economies in Asia.

The fund opens the door to renewable energy and energy efficiency projects in emerging Asia to make it easier for them to secure financing to help get their projects off the ground.

Smaller companies and projects in this industry face a financing gap because larger banks and financial institutions do not traditionally provide them loans due to their size, complex risk profile and their need for a structured financing solution.

This investment is also in line with AIIB’s target of investing 50 percent of its annual direct financing into projects that support climate change mitigation or adaptation by 2025.

The fund, which has a target size of USD500 million, is expected to improve electricity access and security, promote energy efficiency and help reduce the carbon intensity of electricity supply of AIIB’s regional members.

Climate finance accounted for 39 percent of total financing approved by AIIB in 2019, up from 35 percent over the previous three years combined.

This is a Businesswire Feed; edited by Clean-Future Team