Global banks earned more money from financing environmentally friendly projects for the second consecutive year, surpassing their earnings from funding oil, gas, and coal activities. These banks collectively made approximately $3 billion in fees from arranging debt for green investments.

In comparison, the fossil fuel industry made less than $2.7 billion from fossil fuel transactions. This shows that large banks are starting to show interest in green investments, which is significant because a lack of access to capital has been a hindrance to clean energy investments.

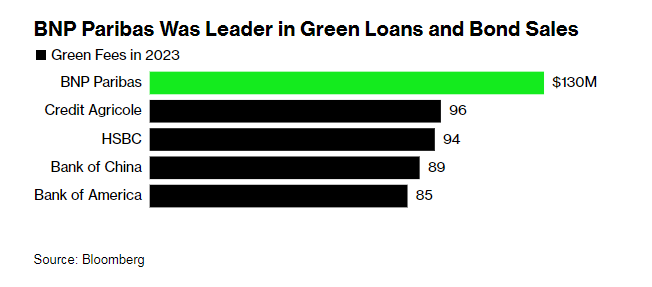

European banks, namely BNP Paribas, Credit Agricole AG, and HSBC Holdings, were at the forefront of the transition towards green debt. BNP Paribas emerged as the leader in Bloomberg’s analysis, having earned around $130 million from its green finance business in the previous year. Credit Agricole AG followed closely with $96 million, while HSBC Holdings earned $94 million.

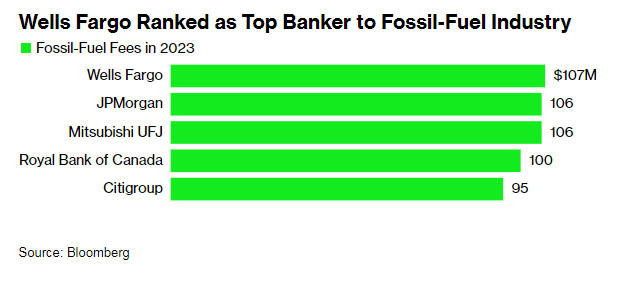

Meanwhile, Wall Street dominated fossil finance, with Wells Fargo and JPMorgan Chase generating the biggest earnings from oil and gas deals.

Regulations play a crucial role in encouraging investments in environmentally friendly initiatives. The European Central Bank and the top banking authority in the EU have expressed their desire for the finance industry to accelerate its shift towards green practices. European lenders now face potential penalties and increased capital requirements if they mishandle climate-related risks. Consequently, numerous banks are implementing specific limitations on funding for fossil fuel projects.

In the US, the regulatory landscape varies considerably. Numerous Republican-led states have close ties to the fossil fuel industry, which actively contributes to the election campaigns of politicians who will safeguard its interests so several states are creating obstacles for green investments.

Although there is positive news, the global finance industry has not made enough progress to achieve the objectives outlined in the Paris climate agreement.

According to an analysis by BloombergNEF, four times as much capital needs to be allocated to green projects as to fossil fuels by 2030 to align with net zero emissions targets. Yet at the end of 2022, that ratio was just 0.7 to 1, largely unchanged from the previous year, BNEF’s latest figures show. Bank financing isn’t “anywhere close” to the transition levels needed.

Banks still aren’t keeping pace with the rate of transition that’s required to avoid catastrophic climate change.

Reference- BloombergNEF, Bloomberg article, Mercom India, Reuters, Economic Times